We believe in securing your

financial future

We make investing in property easier, striving to provide those who partner with us the financial freedom to reach their goals by using our collective property experience and capabilities, and actively managing assets to produce great returns. Our focus is drawing on and building our experience in the property market in order to achieve our investors’ goals.

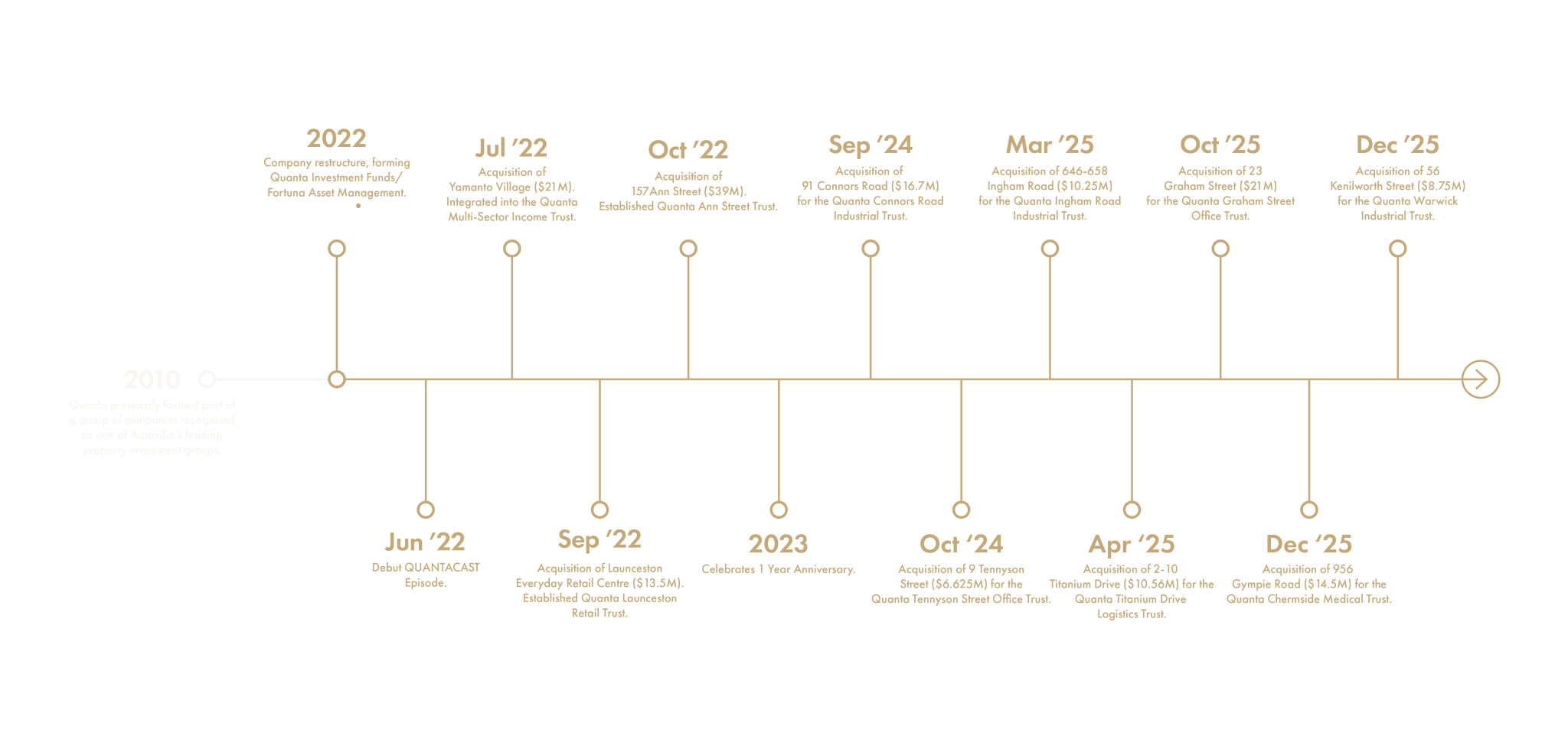

Quanta previously formed part of a group of companies recognised as one of Australia’s leading property investment groups, providing funds management services for over a decade.

History

Founding Director Stacey Jones launched the Quanta Investment Funds brand in 2022, which was previously part of one of Australia’s leading property investment groups, providing funds management services for over a decade.

In its first year under the Quanta Investment Funds brand, Quanta purchased over $80m of commercial property, increasing the value of assets under management to $200 million across six investment trusts. Today, Quanta owns and manages 16 properties across 11 investment trusts, with over $270 million in funds under management.

Quanta’s current team comprises 25 specialists with decades of combined experience across funds management, asset and facilities management, property development and capital transactions.

FY2025 Annual Review

At Quanta, we deliver on our commitment to openness and transparency through regular communication and tailored support. This review provides a detailed overview of our Trusts, an insight into how we engage with our investors and an outline of the deliberate actions we have taken to meet our ESG goals.

Take a read through our achievements and plans for growth moving forward.

Our Departments

Our team is a highly experienced and regarded team of property experts who are leaders in their field. With an unrivalled pool of knowledge, understanding and insight into the property market, we consistently demonstrate success in the planning, development and management of all facets of strategic real estate management with a key focus on maximising the assets performance for our investors. Our collective knowledge and experience delivers quality results for both our tenants and investors, nationally.