Interest rates, inflation and the Quanta Multi Sector Income Trust

Inflation and interest rates are two of the most spoken about terms for investors and at Quanta, things are no different. We appreciate this may create a level of uncertainty when assessing potential opportunities and understand that it is not simply future growth, but also loss aversion, driving investment decisions.

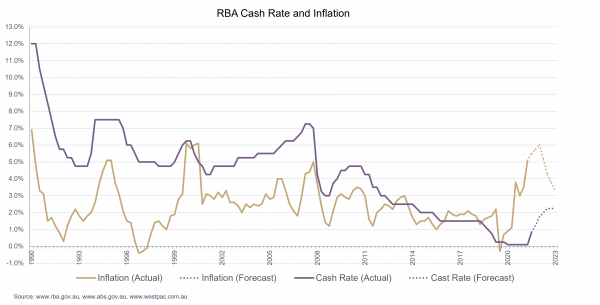

Consumer recovery, supply chain disruptions and an energy crisis have created a perfect storm for surging inflation. In determining this week to increase the cash rate by 50bps to 85bps (0.85%), the RBA noted the following:

• Inflation has increased significantly with both global and domestic contributing factors

• Inflation expected to increase further, but decline back toward the 2-3% range next year

• The Australian economy is resilient, growing at 0.8% for the March quarter and 3.3% over the year

• The labour market is strong with the unemployment rate at 3.9% (50 year low)

• The size and timing of future interest rate increases will be guided by the incoming data and the Board’s assessment of the outlook for inflation and the labour market

With this uncertain outlook, why invest in the Quanta Multi-Sector Income Trust (QMSIT)?

Inflation: Investing passively through QMSIT can help achieve inflation-hedging advantages without the burden of active management

1. Property values typically trend up steadily over time. While there are many provisos to a general statement of this kind, the socio-economic, commercial and financial characteristics of the assets in QMSIT alone create strong expectations of following this trend. Yamanto Village is located within the City of Ipswich, the fastest growing Local Government Area in Queensland with a population expected to double within 20 years, overtaking the Sunshine Coast. The 3 existing medical properties within QMSIT are located in the Mackay Region where residential demand remains extremely strong, with the most recently recorded vacancy rate of 0.5%.

2. Income producing property can act as a hedge against inflation, often keeping pace with, or exceeding inflation, where rent increases are set above the long-term inflationary outlook or tied directly to Consumer Price Index (CPI). With 3% being the upper end of the inflation target set by the RBA in 1993 and the annual inflation rate over the last 25 years averaging 2.5% (Source: ABS / RBA 28 April 2022), QMSIT’s rental increases compare favourably:

Yamanto Village

- Reviews for over 30% of rental income are directly linked to CPI

- 20% of rental income is to be increased by 4% or reset to market rental rates in the coming year

- The remaining 50% of fixed rental income will have an annual average increase of greater than 3%

- Lease expiries are staggered enabling rents to be set to market rental rates

Mackay medical assets

• Fixed rent reviews of 3% annually

3. Healthcare and fuel-based tenants underpin over 70% of QMSIT income – both are strong performing industries with relatively low susceptibility to inflationary pressures.

4. The existing 3 Mackay medical assets are subject to triple net leases, meaning the tenant is responsible for all outgoings as well as repairs and maintenance (including those of a structural nature). Eleven out of thirteen leases at Yamanto Village are net leases – where tenants contribute to outgoings, including non-structural repairs and maintenance. This helps insulate the Trust against the effects of inflation and other increases to costs and outgoings that would otherwise affect cash flow.

5. Long WALE of 8.42 years provides security while staggered expiries still provide the opportunity for active management to implement value enhancement strategies at suitable intervals.

6. Investing passively through QMSIT can help achieve inflation-hedging advantages without the burden of active management.

Interest rates: Our distribution guidance of 6.50% in year one, anticipated the recent interest rate rises and anticipates further interest rate rises by the RBA throughout 2022/23

Our Capital Transactions team is in the market actively looking at new opportunities with careful consideration given to the effect of interest rates on asset pricing both historically and into the future.

When determining the pricing for the acquisition of Yamanto Village into QMSIT, particular attention was paid to increasing costs of debt in our assumptions and calculations for distribution. The Funds Management Team have prepared a cashflow forecast based on a number of assumptions, including but not limited to, interest rates, tenant renewal probability, future market rents, leasing and incentive costs and capex costs over this period. Our distribution guidance of 6.50% year one anticipated the recent interest rate rises and anticipates further interest rate movements by the RBA throughout 2022/23 and beyond. The Trust’s interest rate and expenses contingency is set at 7% of net operating income in year 1 with a further contingency budgeted for a portion of distributable funds retained each year for items including interest rate rises. We consider the Trust to be well capitalised and the distribution rate to be sustainable over the forecast period.

If you require any additional information, our team are only too happy to provide further clarification or details, please feel free to contact us.

Important Notice:

All information in this article has been prepared for the purpose of general information only, without reference to any particular person’s investment objectives, financial situation or particular need. Potential investors should obtain their own professional advice before making any investment decisions. Neither Quanta Holding Co Pty Ltd (ACN 601 712 707, AFSL No. 477075), nor any of its related entities or associates, give any guarantee or provides any assurance as to the performance of an investment in or the underlying assets of, the funds, the repayment of capital or any particular rate of capital or income return. Investments are subject to investment and other risks, including delays in repayment and loss of income and capital invested. Past performance is not a reliable indication of future performance. Nothing on this article constitutes an offer or invitation in any place in which, or to any person to whom, it would not be lawful to make such an offer or invitation. The distribution of this information may be restricted by law and persons who come into possession of it who are not in Australia should seek advice on and observe any such restrictions. Any failure to comply with such restrictions may constitute a violation of applicable securities laws.