Quanta Connors Road Industrial Trust

Investment Resources

Information Memorandum

Investment Update

Why Mackay?

Strategic Location

Mackay is located approximately 960 kilometres north of Brisbane and is Queensland’s fourth largest regional city being populated by 127,000 people. The region benefits from a diverse range of economic drivers including Agriculture, Mining and Resources, Health, Construction, Bio-futures, and Tourism.

Strong Economy

With a Gross Regional Product of $3.9 billion (30% increase over 2022), the region contributes more GRP per capita to the Queensland Government than any other region in the state. Mackay also has one of the lowest residential vacancy rate in Queensland of 0.6% as at Q1 2024.

Booming Resources Sector

The primary export from Mackay is Coking Coal which is essential to the production of steel and the spot price is currently sitting well above historic prices, the spot price as of Q1 2024 was $306/tonne which is approximately three times the price in Q1 2020 ($110/tonne).

Significant Investment

There are $45 billion of projects either proposed or underway within the Greater Whitsundays Region (Mackay, Isaac & Whitsundays). Within Mackay there are $1.5 billion in infrastructure projects, $1.8 billion in construction projects and $1.3 billion in utility projects currently underway.

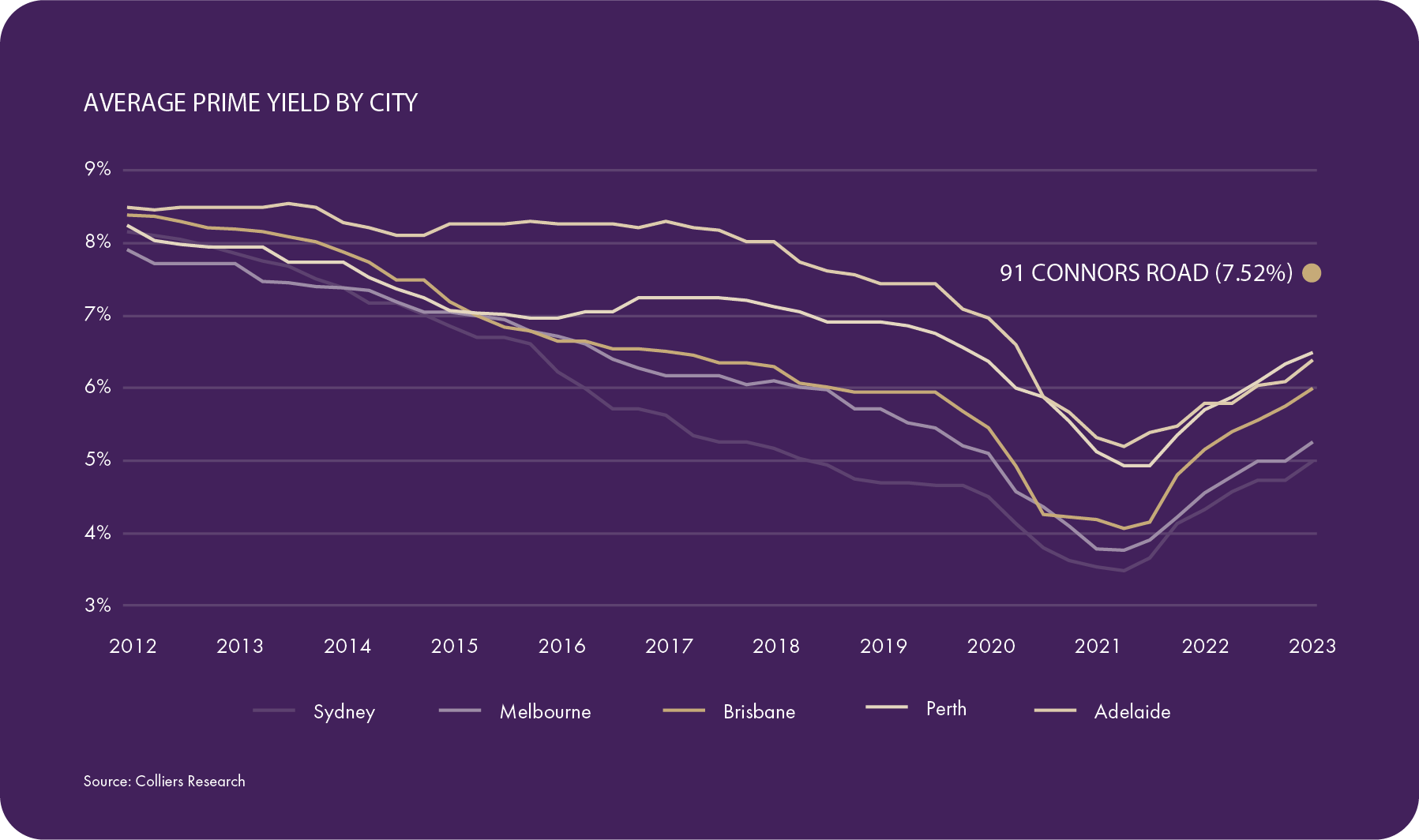

Industrial Sector Overview

Most key performance metrics such as vacancy and rents at a national level continue to outperform historical averages and this trend is expected to continue throughout 2024.

The national vacancy rate for the industrial sector remains exceptionally low at just 1.0%, underscoring the high demand and limited supply within this market.

Industrial weighted net face rental growth was reported to be 21.5% in CY2023, remaining approximately 6 times greater than the 10-year annual average of 3.0%.

In response to heightened levels of occupier demand, CY 2023 produced the largest annual level of supply on record at 3.3 million square metres. However, this has done little to alleviate demand pressures, with over 80% of the supply completed being pre-committed.

Location

Register your interest

If you want to learn more on investing with Quanta, simply enter your details below and one of our team members will be in touch.